You notice a ring you were given by a loved one is no longer where it should be, you immediately start thinking where it could be and what you can do to get it back, insurance!

If you need to make a contents insurance claim, you will generally need some evidence of ownership, to prove the stolen or damaged item belonged to you and to demonstrate the dollar value of the item.

What is accepted as proof of ownership?

- Receipts and/or tax invoices

- Photos in which the items appear in your home or on your person

- User manuals / warranty booklets

- Bank/credit car statements that show you purchased the goods

- Jewellery valuations

- Serial numbers

Suggestions on how to retain proof of ownership

- Maintain an electronic document folder

- Scan copies of receipts as original copies can fade

- Take photos of items in your household including jewellery and electronic items

As your insurance broker we keep files with each client’s personal insurance information. If there are items you purchase and have valuations or receipts for you can send these through to your broker to retain and keep on your file.

For any antique jewellery we do suggest getting up to date valuations for your records, this can make a big difference when it comes to a settlement of a claim to make sure you get the full value of the item.

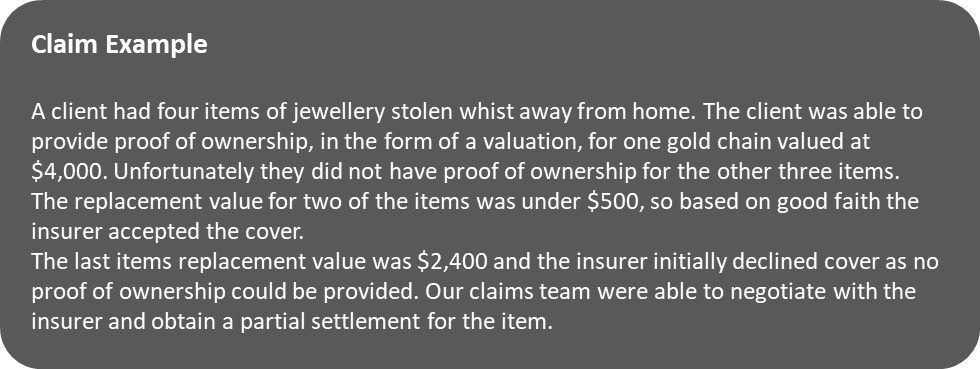

Having proof of ownership can help ensure a smoother claim process but we do understand you may not have all the information required. As your broker we will do everything we can to substantiate a claim to have it accepted and paid for you.

When you have a claim we are here to help!

It does vary when it comes to what different insurers will accept as proof of ownership, so when you do lodge a claim our claims team will be able to advise what documentation may be required and to assist you through the claim process.